A Guide to Capital Gains Tax on Cryptocurrency in the UK

Cryptocurrencies have been gaining increasing popularity in recent years, hitting the mainstream, getting everyone talking, and getting many investing. As the new monetary system began gaining traction so quickly, governing bodies have been scrambling to expedite the lawmaking required to manage it effectively.

This new financial frontier is a considerable disruptor to systems as we know them, and it’s common for those getting involved in cryptocurrencies to be unsure of the laws and guidelines they must follow, including how taxation is applied to it.

The way in which cryptocurrency is taxed essentially depends on how you earn it and the amount of profit you are making. Here is a guide to capital gains tax on cryptocurrency in the UK.

Is there a specific UK cryptocurrency tax?

In short, no, there is no specific taxation legislation for crypto in the UK. This is because cryptocurrency itself is recognised as tokens by the HMRC (His Majesty’s Royal Commission) rather than any form of legal tender (money). Instead Crypto is taxed using older UK tax principles that are based on case law and other pieces of legislation. Nevertheless, it isn’t quite as simple as that when it comes to paying tax on it.

How is crypto taxed in the UK?

There are two main categories regarding crypto tax in the UK:

- Income Tax: Once you earn over the tax-free threshold of £12,570, any additional income made on cryptocurrencies with be taxed

- Capital Gains Tax (CGT): If you make a profit of more than £12,300 through selling, spending, swapping, or gifting crypto, you will be required to pay CGT on those profits

When do I need to pay crypto tax as Income Tax?

Anyone who earns crypto in the UK must pay both Income Tax and National Insurance (NI) on the amount, just as they do when earning GBP (British Pound Sterling).

The requirement to pay Income Tax on crypto in the UK can result from the following:

- Being paid in crypto by your employer: despite this being a form of non-cash payment, HMRC still deems it as income

- Crypto mining: any rewards that result from you validating cryptocurrency transactions on a blockchain network are considered miscellaneous income

- Crypto staking: any tokens awarded to you through the process of staking in crypto are also classed by HMRC as miscellaneous income

- High level trading crypto: most crypto investors and traders will pay Capital Gains tax on trading crypto. Although there are some exceptions, from a UK tax perspective, where there is a Crypto trading business the profits will be taxed as income tax.

- Receiving crypto airdrops: when you received airdropped cryptocurrencies instead of GBP in exchange for providing a service, it will be classed by HMRC as miscellaneous income

As mentioned earlier, if you earn over the UK personal allowance of £12,570, you will need to pay tax on any cryptocurrency income you earn (as per the scenarios above). The amount of income tax you will pay on your crypto income will depend on the Fair Market Value (FMV) of the crypto income as of the date and time it was received, and your relevant tax band.

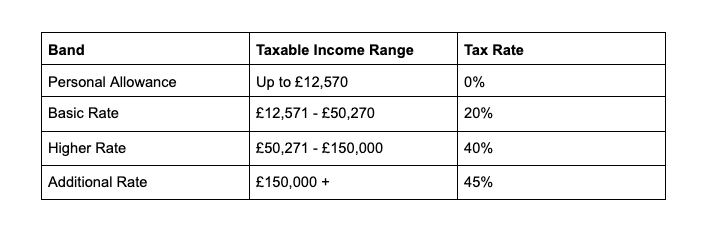

As of 2022-2023, the UK Income Tax bands are as follows:

Band Taxable Income Range Tax Rate

Using this table, for example, if your regular income is £62,000 and you earn £10,000 in cryptocurrency, your total income of £72,000 will still fall into the Higher Rate tier, and you will pay 40% tax on your total combined income over £12,570 (e.g., £72,000 minus £12,570). You can use the HMRC calculator to help estimate how much tax you will be required to pay.

When do I need to pay Capital Gains Tax on crypto in the UK?

In the UK, HMRC classifies crypto as a financial asset and is taxed accordingly. This means that when you either sell, swap, or gift crypto in the UK, it is considered a taxable event, the profits of which are subject to Capital Gains Tax. (CGT).

All UK citizens are entitled to a Capital Gains Tax Allowance, which as of 2022-2023, is £12,300. This means that, so long as your cryptocurrency profits in any one year do not surpass £12,300, you will not be required to pay capital gains taxes or report them as capital profits.

In the cases where your crypto profits do exceed £12,300, you will need to report them as profits in your self assessment tax return or year-end accounts and pay CGT on them accordingly. The manner in which you make crypto profits that will be subject to CGT include:

- Selling your crypto in exchange for GBP: if you sell your cryptocurrency for more than it cost to buy it, the profits you make will be subject to CGT

- Swapping cryptocurrencies: if you swap one form of crypto for another, any profits made on the swap will be subject to CGT

- Using crypto to purchase goods and/or services: when you spend crypto on goods and/or services, any profits made will be subject to CGT

- Gifting crypto: if you gift cryptocurrencies to a third party (other than your spouse or civil partner), any profits made between purchasing it and gifting it will be subject to CGT

It’s also important to note that the time it takes for these profits to accrue is irrelevant; whether the profits made took an hour or two years to grow, the same CGT will apply.

How much CGT will I have to pay on my crypto profits?

If your crypto trading profits exceed £12,300 in any one tax year, CGT will apply, and the rate of CGT you will be required to pay will depend on your Income Tax Band.

Before you can ascertain what your capital gains tax bill liabilities will be, you will need to work out your exact crypto profits. To do this:

- Calculate your ‘cost basis’ for each of your (CGT-relevant) crypto transactions. To do this, simply add the amount you originally paid for the crypto, plus any additional transaction fees. For example, if you paid £10,000 for 1 Bitcoin (BTC), and the purchase cost you £100 in transaction fees, the cost basis for this crypto asset would be £10,100.

- Deduct this cost basis amount from the value of the crypto at the time of disposal; this is how to work out how much the crypto asset was worth at the time it was sold, gifted, spent, or swapped. For example, if your cost basis for the 1 BTC was £10,100 and you subsequently sold it for £13,500, your profit would be £3,400. This amount is what is known as your ‘Capital Gain’ amount.

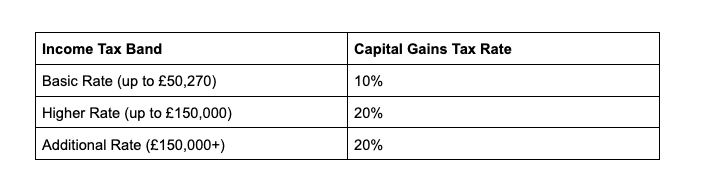

- Check the CGT rates table to see which rate applies to you based on your Income Tax Band. The rate of tax you will need to pay on your Capital Gains will depend on the Income Tax band that applies to you.

Here is the Capital Gains Tax rate table as of 2022-2023:

As an example, let’s say you’re a higher rate taxpayer and you make £25,000 of crypto profit in a tax year, you would deduct the CGT-free allowance of £12,300 from your profit, and then pay 20% CGT on the remaining £12,700.

What if I make a loss on my crypto assets?

When you make a loss on crypto (or any other chargeable asset), you may be able to use those losses to reduce the total amount of taxable gains. Losses can only be claimed within four years from the last day of the tax year in which the loss was incurred.

How to minimise paying Capital Gains and Income Tax on cryptocurrency in the UK

First up, it’s important to note that while the UK’s CGT tax-free allowance is currently £12,300, this amount is scheduled to drop to £6,000 from April 2023 and further down to £3,000 from April 2024. So, be on your toes to make the most of the CGT savings before the tax-free allowance dwindles considerably.

There are a few ways to legitimately minimise the amount of Capital Gains Tax to pay on cryptocurrency in the UK. The following types of crypto transactions are not subject to either Income Tax or Capital Gains Tax in the UK:

- Making a crypto donation: in the UK crypto donations are income tax deductible, allowing investors to strategise how much income tax they are liable for. Just make sure the charity is registered and that the donation is not made to an individual connected to you (the donor).

- Gifting crypto to your spouse or civil partner: Transferring crypto between spouses is currently exempt from CGT in the UK, making for a handy tax-free gifting loophole. This means that spouses and civil partners can effectively double the CGT allowance available to them (£24,600 as of 2022-2023). This benefit only applies if you live together and are not separated. This can also be of financial benefit in the case that one partner is in a lower CGT band than the other.

- Harvesting your losses: capital losses can only be realised when you sell, spend, gift, or trade your crypto, so if you have some unrealised losses taking up room in your portfolio, it might be of benefit tax-wise to sell them at a loss - this is also called ‘tax loss harvesting.’

- Investing in a SITR or EIS: you can defer a portion of your cryptocurrency tax bill by investing in either government scheme. Capital gains made on investing in a Social Investment Tax Relief (SITR) or Enterprise Investment Scheme (EIS) are exempt from CGT when held for three or more years.

- Investing your crypto into a pension fund: this is possible, although not entirely straightforward, so check with your accountant or financial advisor when considering this option.

- Using the UK’s tax breaks on trading: if you earn less than £1,000 in cryptocurrency income in any one year, you do not need to declare it to HMRC (even if your other earnings exceeded the regular income threshold of £12,570.

Does HMRC track crypto?

Yes. HMRC runs a data-sharing program with all UK financial exchanges, including crypto transaction data going all the way back to 2014. Additionally, HMRC holds any KYC (Know Your Customer) information that you have provided during any UK exchanges or wallet sign-ups.

Get expert advice on crypto tax UK

The laws and regulations governing cryptocurrencies and crypto taxes are developing all the time, and in any case, the best way to ensure that you are maximising your financial position is to seek expert financial advice.

Consult with one of our

crypto accountants to determine the best course of action for managing and reporting your crypto investments. For capital gains tax purposes or if you need to pay tax on crypto or file crypto taxes, our experts can minimise your tax liability. To book a free consultation,

click here.